Business Vehicle Deduction 2025 - Commercial truck depreciation calculator JeannieElli, The biggest benefit of the current auto deduction is the strategy of bonus depreciation. For 2023, a vehicle qualifying in the “heavy” category has a section 179 tax deduction limit of $28,900. Everything you need to know about claiming your vehicle as a business, Buying a new car is a giant expenditure. With the standard mileage rate, your business mile deduction will be based on 67 cents per mile for 2025 (65.5 cents per mile in 2023).

Commercial truck depreciation calculator JeannieElli, The biggest benefit of the current auto deduction is the strategy of bonus depreciation. For 2023, a vehicle qualifying in the “heavy” category has a section 179 tax deduction limit of $28,900.

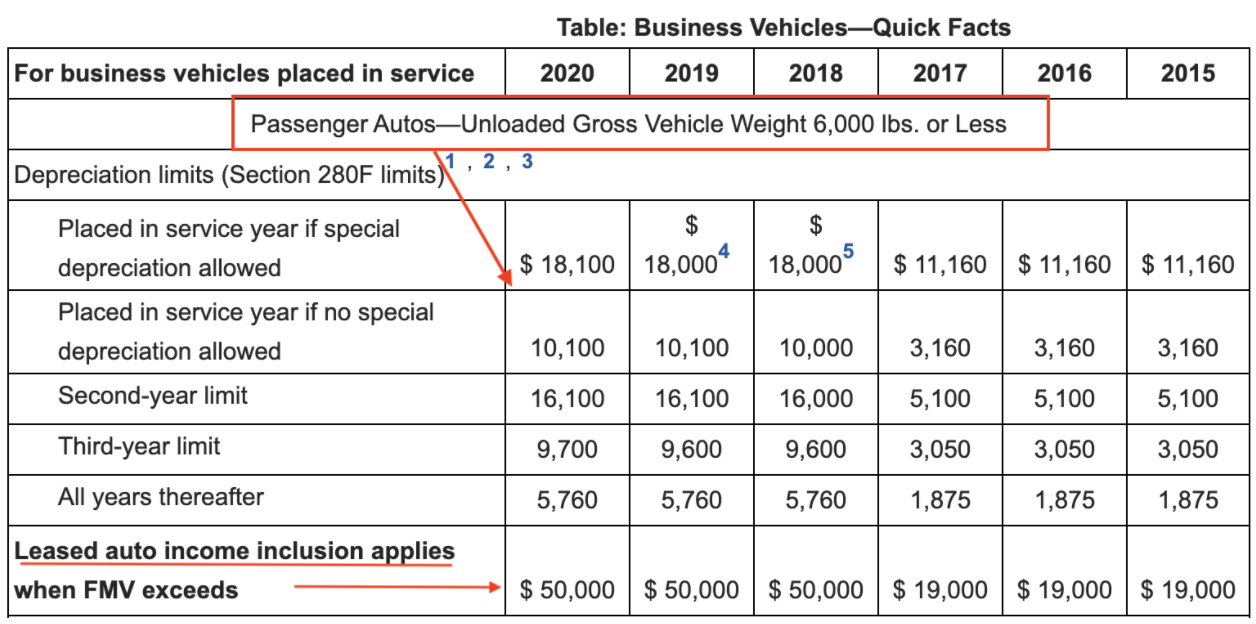

How to Maximize Your Business Use of Car Tax Deduction — RBA Tax Advisors, If you use your car only for business purposes, you may deduct its entire cost of ownership and operation (subject to limits discussed later). The maximum deduction for 2023 is $25,000 for larger suvs and $11,160 for smaller cars.

What is a business vehicle deduction? Finance.Gov.Capital, This deduction depends on the vehicle and the percentage of time you drive it for your business, and there are several exceptions. Find out if your work vehicle qualifies for a.

Section 179 Small Business Tax Deduction Universal Nissan, This simply means that drivers won’t have to stop at plazas to pay toll charges as the toll will be deducted automatically from the bank account of vehicle owners. The biggest benefit of the current auto deduction is the strategy of bonus depreciation.

For 2023, a vehicle qualifying in the “heavy” category has a section 179 tax deduction limit of $28,900.

Tax Deduction for Buying a Car for Business Everything You Should Know, The insurance regulatory and development authority of india (irdai) has made it mandatory to hold new insurance policies in electronic format from. Keep in mind that the section 179.

To deduct your mortgage interest, you'll need to fill out irs form 1098,.

This category includes various costs. Today, the department of finance canada announced the automobile income tax deduction limits.

Podcast 131 Rules for Business Vehicle Tax Deduction YouTube, Section 179 and other vehicle deductions. This category includes various costs such as fuel, insurance,.

Business Vehicle Deduction 2025. December 21, 2023, 2:31 p.m. With the standard mileage rate, your business mile deduction will be based on 67 cents per mile for 2025 (65.5 cents per mile in 2023).

Business Vehicle Deductions Actual Expense Method Bethesda CPA, Financial advisors who work with self. For 2025 these amounts change to: